Reloadable Visa playing cards are preloaded credit cards that may be loaded with price range after which used wherever Visa accepts credit playing cards, including online buying, shops and ATM. As they’re untethered from bank bills or conventional credit/debit playing cards, reloadable visa playing cards make themselves on hand to folks who may in any other case no longer qualify for them – consisting of those without financial institution bills or traditional credit/debit cards themselves.

Features of Reloadable Visa Cards:

Reloadable In assessment to disposable playing cards for prepaid Reloadable Visa cards can be topped up with money in a couple of instances.

Worldwide Acceptance This card may be utilized everywhere in the international, as long as Visa accepts it.

Spending management: Since you may only spend the quantity you loaded to your card, it’s less complicated to manipulate your spending.

No Credit Checks: Most reloadable Visa cards don’t want a credit check which makes them available to humans with susceptible and no history of credit score.

Benefits of Reloadable Visa Cards (Preloaded Cards)

Reloadable Visa playing cards provide numerous benefits that lead them to appeal to several customers.

Here are some key ones:

Budgeting and Financial Control: Reloadable Visa playing cards permit you to deposit an amount that will help you finance your spending and stay with your monetary plan more without difficulty, that’s specifically beneficial in case you generally tend to overspend with credit score cards.

Safety and privacy As Visa cards can be reloaded, they provide an extra layer of safety from theft. Should your card be lost or stolen, damages will most effectively extend as much as its fee, and making use of these playing cards to shop online can shield number one bills in opposition to fraud.

No Credit Checks Needed: Reloadable Visa playing cards may be greater widely on hand in view that they do not require a credit score take a look at them, making them a suitable solution for people with low or no credit histories.

Multi-Use: These cards may be used for many exclusive tasks, from online buying and payments, booking tour reservations, and taking flight cash at ATMs to retreating price range at an ATM.

Reloadable Visa cards make wonderful gives that permit their recipients to apply them wherever Visa is widely widespread, whilst also being best for vacationers who don’t desire to hold massive sums of cash or deliver a couple of credit playing cards in overseas nations.

How to Buy Reloadable Visa Cards Online

The purchase of a reloadable Visa card online can be easy but it’s miles critical to pick a straightforward service and be aware of the situations and charges related to the credit card. Below is a step with the aid of step guide to manual you through the manner:

Search Providers You need to start by searching out dependable carriers that offer rechargeable Visa cards. The maximum well-known ones incorporate Netspend, Green Dot, and PayPal. Check out evaluations, examine expenses, and look over the functions of the cards to find the first-class one for your wishes.

Visit the provider’s internet site: Once you’ve selected certainly one of them, check the legit website of their company. Find the phase that announces they offer Reloadable or prepaid Visa cards.

Select your card: Select the form of a rechargeable Visa card you wish to buy. Certain card providers provide several picks with distinct traits, so select one that is well-matched along with your needs.

Sign-Up: You will want to sign in to your account at the service issuer. It normally calls for you to provide non-public details, just as the name of your address and e-mail deal with.

Buy the Card: Follow the commands to shop for the cardboard. It is feasible that you’ll want to pay a preliminary amount to purchase the cardboard. You can pick to switch an initial quantity on the card.

Validation: Some carriers may additionally need you to verify your identification earlier than you’re able to utilize the playing cards. This manner is commonly finished via imparting a reliable authorities ID.

Get and activate the card: After purchasing the cardboard you may receive it through the mail. Follow the activation steps which might be furnished using the provider issuer usually, which incorporates calling a toll-loose phone variety or traveling a website.

Crediting your Card When you’ve obtained the card, it is capable of recharging it via the usage of a variety of strategies including direct bank transfer, deposit, or coins at outlets that can be taken part.

Top Providers of Reloadable Visa Cards

When selecting a chargeable Visa card provider, it’s important that you pick a reliable organization with transparent costs and offerings. Here are a few popular vendors:

Netspend sticks out as one of the main carriers of rechargeable Visa cards. They offer several services, including direct deposit, cell banking, and cashback rewards; you can load those playing cards at banks, outlets ATMs, or banks themselves.

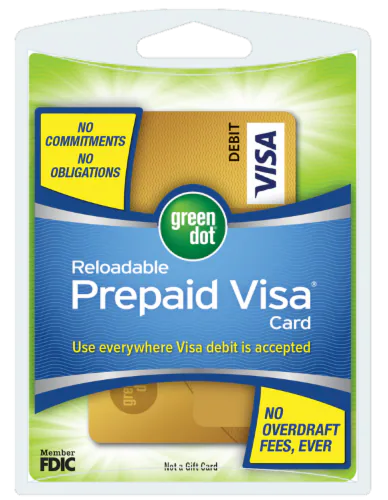

Green Dot: Green Dot is another well-set-up organisation providing rechargeable Visa cards with features along with ATM withdrawals, bill payment online, coins rebates on purchases, and more. Green Dot playing cards can be recharged at various places in the U.S.

PayPal Prepaid Mastercard: The PayPal Prepaid Mastercard is a reloadable credit score card related without delay PayPal that makes money transfers easy and offers extra capabilities which include depositing at once, ATM get entry and shopping online or in stores accepting Mastercard charges.

Walmart MoneyCard: The Walmart MoneyCard is a chargeable Visa card that gives buyers coins-back whilst making purchases at Walmart shops, at the side of loose ATM withdrawals, online bill pay abilities, and the functionality to make assessments payable through an app referred to as Walmart MoneyCard app.

Chase Liquid: Chase Liquid is a Reloadable Visa Card offered via Chase Bank that lets customers withdraw finances without problems without incurring charges for ATM transactions or deposits of cash via branches. Furthermore, this answer also functions online and mobile banking functions.

Legal Aspects and Considerations Concerning Copyright-Free Submissions

When buying and using Reloadable Visa cards, it’s important to understand their felony implications. As financial merchandise, Reloadable Visa cards must adhere to quite a few legal guidelines and regulations concerning use and issuance.

Legal Considerations:

Mes Its AML Laws: Money Laundering (AML) Legislation: Providers of rechargeable Visa playing cards ought to abide by using Anti-Money Laundering (AML) regulation. This may additionally involve verifying cardholder identities as well as monitoring transactions for suspicious activities.

Consumer Protection Laws: Reloadable Visa playing cards are included by using diverse client protection laws that supply cardholders certain rights together with disclosure of prices and contesting any unauthorized transactions.

Tax Reporting: Funds loaded onto a Reloadable Visa card may also need to be mentioned as tax-deductible while used for commercial enterprise use, particularly if these price ranges are tax deductible.

Considerations Regarding Copyright-Free Items:

No Infringement on Third Party Rechtes: When developing content or offering services that use Reloadable Visa playing cards, no violation must happen of third-birthday celebration rights consisting of copyrights, emblems, or patents belonging to any of their stakeholders.

Original Content All content that promotes or explains the way to reload Visa cards needs to be authentic or available freely within the public domain, in preference to copyrighted cloth without authorization from its creators.

Compliance With Marketing Laws and Rules: Ensure all advertising and marketing materials follow all applicable legal guidelines and rules concerning disclosure, advertising and marketing, patron protection, and extra.

Potential Drawbacks of Reloadable Visa Cards

Reloadable Visa cards offer many advantages; but, you must additionally keep in mind capability drawbacks.

Charges A wide array of reloadable Visa playing cards come with charges including purchase prices and month-to-month preservation fees; ATM withdrawal fees; and reload charges. It is vital to recognize these charges to as it should estimate the general rate of the cardboard.

Limitation on Consumer Protections Contrastingly to credit score playing cards that offer greater consumer protections, Visa playing cards tend to provide restricted consumer safeguards in opposition to fraud and transactions that aren’t authorized. While a number of those cards provide a few types of legal responsibility coverage insurance, their insurance doesn’t examine properly to that of credit cards.

Reloading can be time ingesting: Reloading can vary depending on the service company you operate and may involve visiting an actual region or paying a quantity without delay. Some cards additionally limit how a good deal can be loaded at one time, making the procedure cumbersome for customers who must load larger sums straight away.

Reloadable Visa Cards Don’t Contribute to Credit Building: Unlike credit cards, Reloadable Visa cards do now not make contributions to growing your credit rating due to the fact they’re no longer associated with any credit score reporting business enterprise – common utilization will consequently have any touching on growing it.

Reload Dates of Expirations Cards: Keeping tabs on expiration dates & expenses For your very own peace of thoughts, Visa playing cards generally have expiration dates that must be adhered to otherwise a charge will be assessed for issuing some other card. Therefore it’s vital that you recall these dates of expiration to keep away from any problems in retrieving new ones!

Tips for Effectively Utilizing Reloadable Visa Cards

For the most advantageous performance of your Reloadable Visa card, be aware of these suggestions:

Select an appropriate card: Research numerous playing cards and find one that offers all your preferred functions at affordable fees, taking into consideration factors like reloading alternatives, ATM get right of entry and cashback rewards.

Keep an Eye on Your Balance Securing your credit card can assist protect against overspending or having transactions denied, so take time every month to review its balance and use cell and online banking tools available through providers to you to monitor it and make transactions.

Establish Direct Deposit As quickly as possible, set up direct deposit to mechanically load price range onto your credit card and reduce time and charges associated with reload prices. This may want to shop time and store money.

Reloadable Visa cards may be a powerful device for budgeting. Try putting apart a quantity that corresponds with every one of your month-to-month prices inclusive of enjoyment, groceries, or travel.

Keep a Close Eye on Fees: Pay close interest to all fees related to your credit card, inclusive of ATM withdrawal costs, month-to-month renovation expenses, and reloading costs. You can reduce fees by opting for cards with reduced or no month-to-month fees or selecting ones with loose reloading competencies.

Be Aware of Your Limits: Understand the restrictions positioned upon you via your card provider – which include most reload amounts, everyday spending caps, and ATM withdrawal limits – earlier than setting spending dreams to keep away from potential troubles.

Reloadable Visa cards offer a smooth, steady, and flexible manner to manipulate your cash while not having a financial institution account or conventional credit score card. Ideal for budgeting, online buying, and tours – supplying spending manipulation in addition to extra safety – it’s far vital while selecting an appropriate credit scorecard that you apprehend all its associated costs and any capability drawbacks or feasible drawbacks that might exist.

I would definitely recommend them.

great service provider. virtual card work fine in paypal

I would also like to say thank you to all your staff.

I got my Card Info as fast as possible within 6 hours and also their support and Live-chat are quick and helpful. Thank you guys. I recommended your service to my friends.

It’s a great vcc. Highly recommended.